A Photovoltaic System is a secure income

Brazil: A Landmark for Strategic Investments

You are in Your Access Point to Premium Opportunities in Photovoltaic Installations in Brazil

Do you need to find a Financially Sustainable Impact Abatement Strategy? Looking for a High Yield Investment? Do you want an almost nonexistent risk profile ?

Clear Strategy

Are you looking for an effective and simple solution to reduce your company's environmental impact? Would you like a clear and easy-to-implement solution with definite implementation time and quick payback?

High Yield ASSETS

Learn how an investment in photovoltaic systems in Brazil can turn into a stable and predictable income stream. An opportunity to strengthen your portfolio while reducing financial risk.

Source of Funding

Imagine using revenues from your solar installation to reinvest in sustainable initiatives. This not only improves your ESG balance sheet, but paves the way for more ambitious goals

Maximum Security

With OxygenSavesThePlanet, you will have access to a clear and profitable investment path. Contact us to learn more about how solar energy in Brazil can become the key to your financial and sustainable success

The Benefits of Law 14.300:

OxygenSavesThePlanet is excited to offer a STRATEGIC RESEARCH REPORT: The Solar PV Market in Brazil. September 2023

Greater Legal Security in the Sector:

The law reduces dependence on the regulations of the regulatory agency Aneel, providing a more stable and predictable legal framework.

Possibility of Direct Energy Sales:

Starting in 2024, producers will be able to sell the energy they produce directly, providing more opportunities for revenue and control over revenues.

Access to the TUSD Wire B tariff:

The law allows energy producers to pay a reduced tariff for using the distribution system, increasing the cost efficiency of energy production.

Revolutionize Your Approach to Sustainability:

Sustainability has become an unavoidable necessity. Besides being an ecological commitment, it represents a unique investment opportunity. Companies are increasingly aware that adopting renewable energy is not only environmentally friendly but also cost-effective.

The Future is Green: Photovoltaics

Is going to triple by 2030

While many have already adopted rooftop photovoltaic systems, we explore other possibilities for integrating sustainable solutions into corporate budgets. In Europe, onshore plants present challenges, but turning our gaze to Brazil, the opportunities multiply.

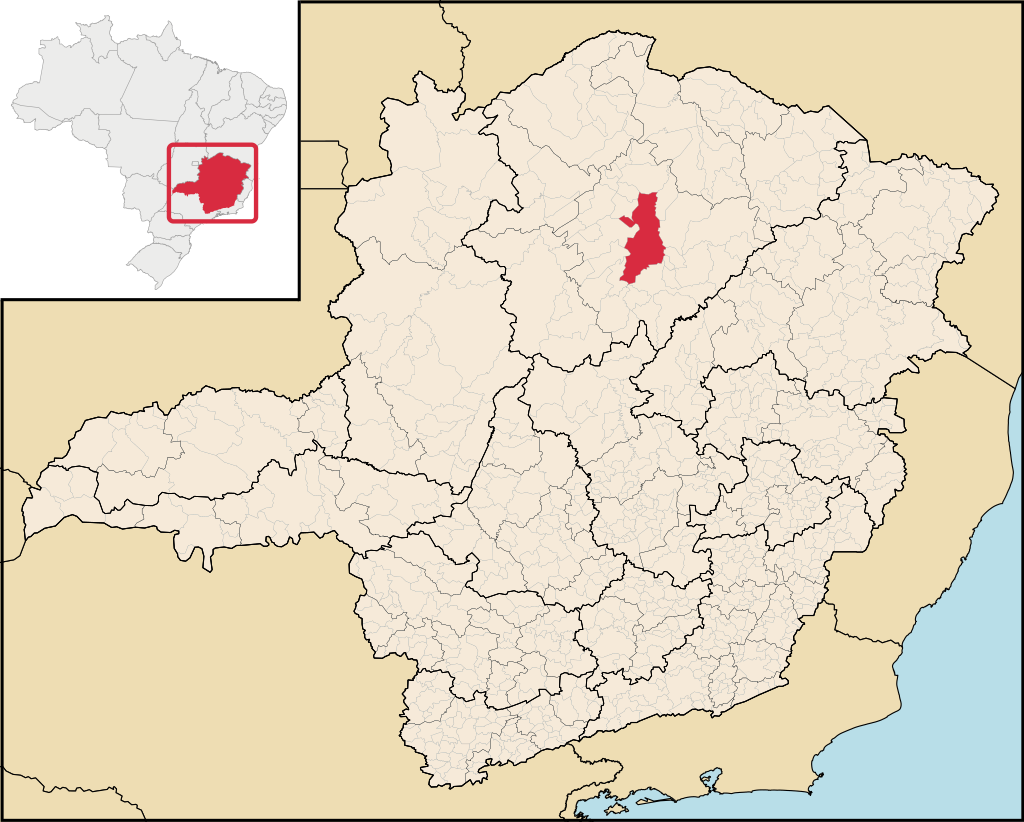

Brazil: A Fertile Land for Solar Investment

Brazil presents itself as an emerging market with a desperate need for energy. Through Law 14,300 of 2022, the country provides a stable regulatory framework and a clear business model for the solar industry. Brazil opens up as an exceptional investment opportunity in renewable energy.

Our Unique Approach

With years of experience in solar projects in Italy and strong ties to Brazil, we offer access to high-quality solar projects. Our network of relationships allows us to navigate the market with confidence.

Legal Security and Financial Reliability

Our legal team, consisting of experts in the field, ensures comprehensive management of all legal and tax aspects of investments. We partner with proven Brazilian developers for 50/50 joint ventures, sharing risks and commitments.

Safe and Profitable Investment

These collaborations result in PV investments with predictable and low-risk returns. With break-even times of only 4 years and an IRR of 25%, we offer a highly advantageous investment prospect.

An Opportunity Not to Be Missed

We firmly believe that this is an opportunity to be seized to achieve outstanding results. We are available to assess your specific needs and provide all the necessary details for an informed investment.

Start Your Path in Photovoltaics Now

Contact us for a personalized consultation and find out how your investment in PV in Brazil can turn into economic success and competitive advantage.

Why Choose Us

ROI

Profitability

ESG Benefits

Attractive returns

Wide Choice

By Size and Type

Reliability

Expertise and Experience

The Context

-

Initial Analysis: We will begin by examining your energy needs and your Sustainability Report, assessing the opportunity for a renewable plant in Brazil.

-

Goal Setting: If you do not already have a clear strategy, we will work together to define a time path for the installation of the system, also considering your investment budget.

-

Training and Information: We will provide an in-depth overview of renewable energy installations and Brazilian market dynamics, ensuring that you can proceed with complete awareness.

-

Plant Selection: We will propose several renewable plant options, taking into account your company’s specific needs and sustainability goals.

-

Maintenance Partner Selection: We will work with you to choose the most qualified and reliable company to maintain your facility, ensuring that your investment is always performing at its maximum potential.

-

Bid Formalization: Once we have identified the ideal solution for you, we will proceed with its formalization.

-

Definition of Payments: We will establish payment methods and timing together, always referring to your needs.

-

Guide to Establishing a Company: We will assist you in setting up a subsidiary company in Brazil, facilitating every bureaucratic and legal step in the process.

- Documentation Provision: You will receive full access to all plant and subsidiary documentation, ensuring transparency at every stage.

-

After-Sales Support: After purchase, we will continue to be by your side for any needs, ensuring constant support.

With us, investment in renewable energy facilities in Brazil will be a transparent, guided process with a strong focus on sustainability and business growth.

Client Testimonials

"As a company active in wind and photovoltaic installations in Italy and Australia, expansion into Brazil was a significant challenge. OxygenSavesThePlanet (OStP) was instrumental in opening the Brazilian market to us, offering attractive proposals and comprehensive legal and technical support. Their expertise turned a complex venture into a tangible success, consolidating our presence in the renewable energy field globally."

"As an agile and innovative investment fund, our entry into the Brazilian PV market has been a game-changer. We discovered a dynamic market full of intermediate-sized PV systems, offering us exceptionally high yields, well above those in Europe.

Collaboration with our experienced and knowledgeable local partners has been crucial: they have provided us with valuable insights and helped us navigate the market with confidence. In addition, first-rate legal assistance ensured smooth and safe handling of all aspects of the investment.

Investing in PV in Brazil has not only been profitable, but also incredibly inspiring and revealing. We highly recommend this experience to those seeking a high-yield investment opportunity in a fast-growing market."

"As a group of entrepreneurs, we consortium for a common goal: to improve the sustainability balance of our companies and to pursue a financially beneficial investment. Our choice to enter into a 50-50 joint venture to purchase a 3 MWp photovoltaic plant in Brazil has led to remarkable results. This partnership has provided us with a stable and predictable return, as well as tangible ESG benefits. Thanks to the expertise of our local partner and exceptional legal support, we turned our goals into reality."

FAQ

What Applies to the Sustainability Report

When European companies or any other international companies purchase goods or assets in another country, including PV systems, the carbon emissions and savings from these assets can be included in their corporate sustainability report. However, the categorization of these emissions into different areas depends on the nature of the emissions:

- Scope 1 emissions: These are direct emissions from sources owned or controlled by the company. For a photovoltaic system, direct emissions are generally minimal because the system generates electricity from sunlight. However, any emissions from backup generators, vehicles or other equipment owned and operated by the facility would fall into this category.

- Scope 2 emissions: These are indirect emissions from the generation of electricity, steam, heating and cooling purchased and consumed by the company. If the European company purchases electricity from the PV plant in Brazil, but does not own or control the plant, the carbon savings (or avoided emissions) from the use of this electricity will be classified Scope 2. If the European company owns and operates the plant, the carbon savings (or avoided emissions) will fall into this category.

- If the European company owns and operates the PV plant in Brazil, the emissions avoided through renewable generation would generally be reported as a Scope 2 emissions reduction for the company, as they offset electricity that might otherwise be purchased from the grid.

It is also worth noting some additional points:

- Site-specific factors: It is essential to consider the emission factor of the local grid in Brazil when calculating carbon savings. If the local grid is already very green (e.g., mainly hydro), the carbon savings from the PV system may be less than in a region with a coal-fired grid.

- Reporting Standards: Different sustainability reporting standards and frameworks may have slightly different rules and guidelines for categorizing emissions. It is critical to be consistent and transparent about the standards used.

- Verification: All claims about savings or carbon emissions in corporate sustainability reports should be verified by third-party auditors to ensure their accuracy and credibility.

In conclusion, if a European company buys and operates a PV plant in Brazil, the carbon emissions or savings associated with that plant can be included in the corporate sustainability report, most likely as a Scope 2 emissions reduction. However, the specific categorization may be different. However, the specific categorization may vary depending on the details of the property, operation, and reporting standards used.

Why invest in renewable energy plants in Brazil

Brazil has enormous potential for renewable energy due to its vast geographic extent, abundance of sunshine and strong winds in many regions. Investment in this sector is stimulated by various government policies, making Brazil one of the most attractive emerging markets for renewable energy installations. Investing in renewable energy facilities in Brazil not only supports the global transition to clean energy sources, but also offers competitive investment returns, especially when considering the growing demand for energy in the country. In addition, with our assistance in establishing a subsidiary and selecting reliable maintenance partners, investors can feel confident and supported every step of the way.