The IVS (International Vending Services) Group is the leader in Italy and the second largest operator in Europe in the beverage and snack vending machine industry. Founded in 1972, it operates more than 290,000 distributors, serving private customers, public agencies and transit places. The group’s mission focuses on innovation, sustainability and consumer focus. IVS Group pursues a strategy of international growth and development, confirming its excellence in the foodservice industry.

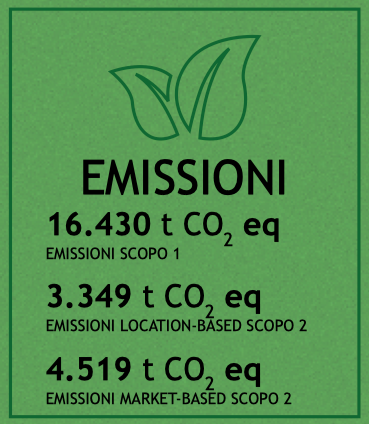

Referring to the IVS sustainability report 2022 we have:

- Total 24,000 tCO₂e

- 16,550 tCO₂e Scope 1

- 7,500 tCO₂e Scope 2

Foreword

Sustainability reports follow a specific categorization of greenhouse gas (GHG) emissions based on “Scopes.” To understand how emissions in one specific “Scope” can be offset or reduced through actions in another “Scope,” it is useful to examine what these “Scopes” represent.

- Scope 1: Direct emissions. These are emissions generated directly by the reporting entity, such as those from burning fossil fuels, industrial processes or vehicles owned by the organization.

- Scope 2: Indirect emissions from purchased energy. These emissions are produced in the generation of electricity, heat or steam purchased and consumed by an entity.

- Scope 3: Other indirect emissions. These are the emissions that do not fall under Scope 1 and 2 and come from sources not owned or controlled by the entity, such as those from the supply chain, business travel, transportation and distribution of products, and so on.

IVS and the Path to Carbon Neutrality: Possible Scenarios Analyzed

IVS Group’s Carbon Footprint is generated:

- mainly from the auto-traction diesel fuel used by the fleet of vehicles used for refilling the 250,000 vending equipment distributed throughout the territory. These vehicles are equipped with refrigeration systems for transporting fresh food and travel with a full load. For these reasons, a shift to lower-impact motor vehicles is not conceivable any time soon.

- Electricity used at company locations and by vending machines distributed throughout the territory. IVS has installed photovoltaic systems to saturate the roof spaces of the locations.

3 Scenarios are possible

The first is annual compensation cost.

The other 2 scenarios are high return investment projects.

Scenario 1: annual compensation with Forest Carbon Credits

What is an estimate of the compensation cost of 25,000 tCO₂e?

Using Forest Carbon Credits at current prices, the annual cost can range from 200,000 euros (low quality and high Vintage REDD+) to 600,000 euros (ARR)

Scenario 2: Investment in a forestry project.

It is possible to invest in a REDD+ (preservation) or ARR (reforestation) project. REDD+ projects have high economic returns. They have come under criticism, especially older projects developed cn outdated protocols. The protocols in use for new projects have been profoundly modified and are sheltered from criticism. ARR projects are fewer in number and are characterized by significant upfront costs (reforestation) that delay the break even of the project. In addition, it is difficult to convince a landowner located in suitable areas to have reforestation that produces a profitable amount of annual biomass (which corresponds to the amount of CO₂ captured) (15 tCO₂e/year/Ha) to reforest an area (grassland) that is usable for otherwise profitable agricultural uses except with a land remuneration that goes heavily into the project.

A REDD+ project is proposed.

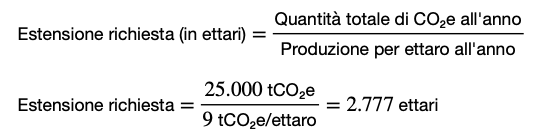

What extent must a forest conservation project (REDD+) have to produce 25,000 tCO₂e/year assuming a production of 9 tCO₂e/year/Ha ?

To calculate the required extent of a reforestation project for it to produce a given amount of tCO₂e per year, we can use a simple formula:

Therefore, a forest conservation project (REDD+) would need to extend about 2,777 hectares to produce 25,000 tCO₂e per year, assuming a production of 9 tCO₂e per hectare per year.

This translates into an investment of about 1 million euros

an annual VCU yield of 250,000 euros (assuming a VCU unit cost of 10 euros) for 12 years.

The project can be renewed upon expiration by incurring only the cost of renewing the project at Verra.

The data are deduced from a project in development 5 times larger in size (11,090 Ha) whose Asking Price is about 3.2 million. The yield of 9 tCO₂e/year/Ha + very high. It is normally 6 tCO₂e/year/Ha.

Scenario 3: Investment in photovoltaic systems

The profitability of renewable energy plants in Brazil is very high for several reasons:

- Brazilian weather conditions are optimal: sunshine-wind.

- Nextron benefits from being a private company in a market environment dominated by monopolistic public companies until the introduction of Brazilian Federal Law 14.300. This law ushered in the Electricity Compensation System (SCEE), providing a legal framework for distributed microgeneration and mini-generation in the country. Energy market prices are very favorable to Nextron and investment due to the inefficiency of traditional competitors.

If I produce renewable energy in-house, can it be considered "non-emission" and be classified scope 1 and thus offset the use of fuels for self-traction?

If a company produces renewable energy internally (e.g., through solar panels installed on the roof) and uses this energy to power its operations, effectively this is a “non-emission” compared to using energy from fossil fuels. In addition, as energy is generated, the related emissions (or missed emissions) can be classified as Scope 1.

However, when we talk about offsetting Scope 1 emissions, such as those from the use of auto-traction fuels, with domestic renewable energy production, we enter a gray area. Ideally, to offset Scope 1 emissions, those emissions should be reduced directly, such as by replacing fossil-fueled vehicles with electric or hydrogen vehicles.

Recording renewable energy produced abroad in the sustainability report of an Italian-based company can be a complex issue and could be affected by various factors, including the sustainability reporting standards followed, local laws and regulations, and the company’s specific operating circumstances.

If, for technical or operational reasons, these emissions cannot be reduced, producing renewable energy internally can actually help improve the company’s overall sustainability profile and reduce its overall environmental impact. This domestic renewable energy production can indirectly offset Scope 1 emissions, but it is not a direct offset in terms of standard GHG protocols.

In practice, many companies take a combined approach: they reduce emissions wherever possible and offset irreducible emissions through various mechanisms, including renewable energy production and the purchase of carbon credits.

In summary, while domestic renewable energy production can effectively reduce the company’s overall carbon footprint and indirectly offset Scope 1 emissions, direct emission reduction should remain a top priority. If direct Scope 1 emissions cannot be reduced, domestic renewable energy production is certainly a step in the right direction toward sustainability.

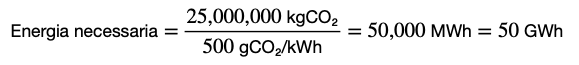

How much electricity from photovoltaics would I have to produce annually to have a "no emission" of 25,000 tCO₂e?

To calculate how much electricity one would have to produce with a photovoltaic system to achieve a “missed emission” of 25,000 tCO₂e, we need to consider two key factors:

- The emission factor of the power grid you are avoiding. This varies depending on the geographical region and the energy mix of the grid. For example, in an area that depends mainly on coal for electricity generation, the emission factor will be much higher than in an area that uses mainly renewable sources.

- The efficiency and productivity of your PV system. This will depend on the quality of the panels, weather conditions, duration of solar irradiation, and other factors.

To simplify the calculation, let us assume an average value of the emission factor. As an example, consider that the average emission factor of a power grid based mainly on fossil sources is about 0.5 kg CO₂/kWh (or 500 g CO₂/kWh). This value can vary greatly depending on your region, so you should find the Italian-specific value.

Using the value of 500 gCO₂/kWh:

Thus, to achieve a “missed emission” of 25,000 tCO₂e, 50 GWh of electricity would have to be produced in one year through photovoltaic system, assuming an emission factor of 500 gCO₂/kWh.

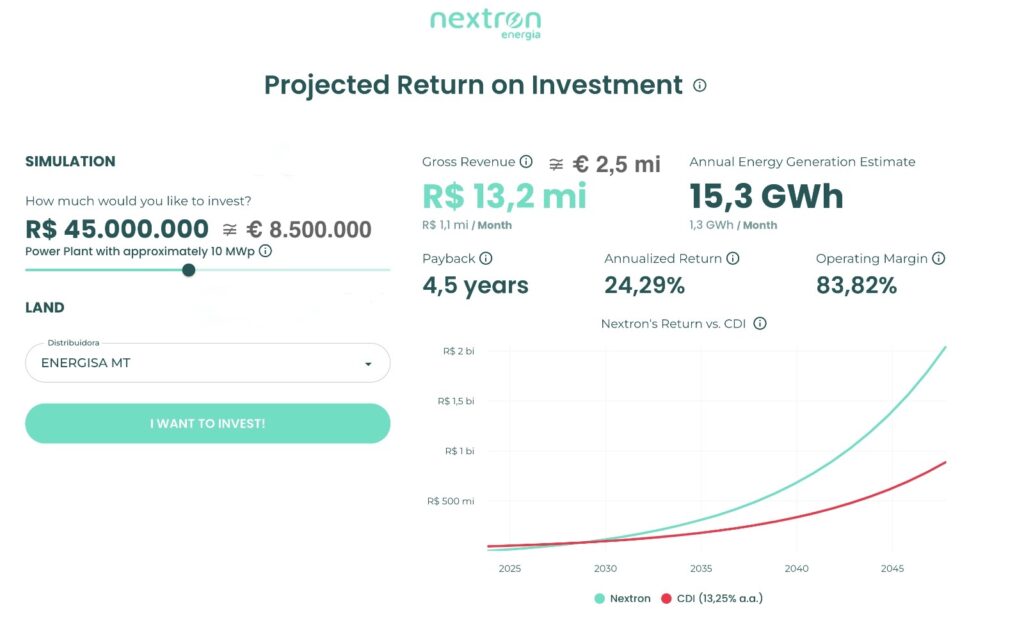

What plant capacity is needed to produce 50GWh per year with the data provided by Nextron and the corresponding investment?

With the data provided by Nextron serves a plant characterized by:

- 32 MWp of power

- 27 million euro investment

- Annual revenue of 8 million euros / annual return of 24%.

- Break Even at 4.5 years.

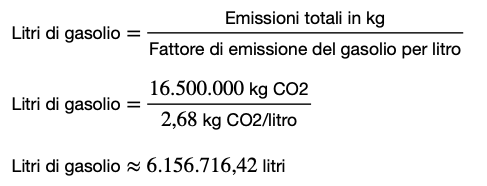

How much auto-traction diesel fuel does 16,500 tCO₂e produce?

We can follow the following steps:

- Identify the emission factor of diesel fuel: Diesel fuel emits about 2.68 kg of CO₂ per liter burned. This figure may vary slightly depending on specific blends and data sources, but it is a generally accepted estimate.

- Calculate the amount of diesel fuel needed: To calculate how many liters of diesel fuel are needed to produce 16,500 tons (or 16,500,000 kg) of CO₂, divide the total emissions by the diesel fuel emission factor:

Thus, it is estimated that about 6,156,716 liters of diesel fuel are needed to produce a Carbon Footprint of 16,500 tCO₂ eq, assuming that all of the Carbon Footprint comes solely from the combustion of diesel fuel in small trucks.

However, it is important to note that this is a simplified estimate. In reality, emission factors can vary depending on many factors, such as engine efficiency, vehicle maintenance conditions, type of route (urban vs. suburban), among others. Therefore, for a more precise estimate, it may be necessary to consider specific data and factors related to the fleet in question.

It is estimated that the business cost of diesel purchase expenditure is in the range of 6 million liters X 1.8 €/lt = 10.8 € million.

So by investing in a “Carbon Neutral” plant.

of 50GWh in 4.5 years is going to reduce

The cost for corporate self-deduction of 80%.

Conclusions

IVS’s investment in carbon credits, forestry projects and photovoltaic energy is a concrete commitment to sustainability. Compared to corporate revenues, the costs associated with these sustainability initiatives are relatively small, but they bring significant benefits:

- Reducing Carbon Footprint:

Actively contribute to the fight against climate change. - Energy Self-Sufficiency and Cost Reduction

Reduces dependence on outside suppliers, mitigating the risks of energy price fluctuations. - Brand Enhancement and Market Differentiation

Differentiates IVS in the market, attracting eco-conscious customers and enhancing corporate reputation. - Regulatory Compliance and Access to Incentives:

Position IVS favorably with respect to future environmental regulations and allow access to renewable energy incentives.i. - Future Investment and Sustainable Growth:

Green initiatives can drive future growth and sustainable innovation. - Stakeholder Engagement:

Stakeholders, including customers, suppliers and investors, are becoming increasingly attentive to sustainable practices. IVS’s engagement in these initiatives can improve the perception of the company as a whole.

In summary, the investment in sustainability, while small relative to overall sales, positions IVS as a responsible leader in the industry, with long-term benefits both financially and reputational-wise.