Introduction:

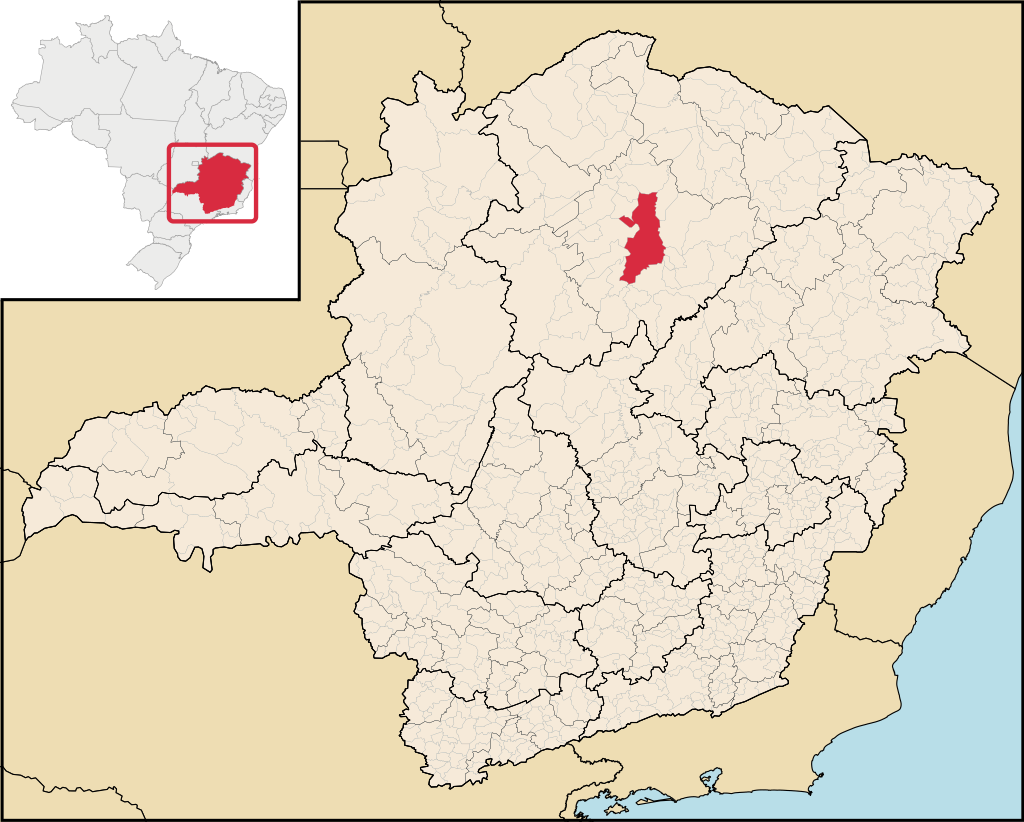

Montes Claros, a municipality located in the state of Minas Gerais, Brazil, provides an ideal setting for an ambitious renewable energy project. With a population of 415,000 and a strategic location in the mesoregion of Norte de Minas, the city offers a favorable environment for the development of a photovoltaic plant.

Photovoltaic Plant in Montes Claros, Minas Gerais, Brazil

Project Details:

– Location: Montes Claros, Minas Gerais, Brazil

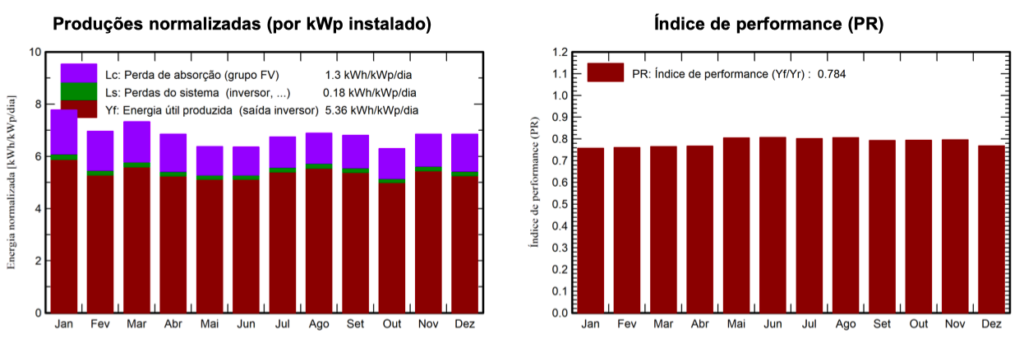

– Plant Power: 2.5 MW ac – 3.36 MWp

– Annual Generation: 6,779,231 KWh

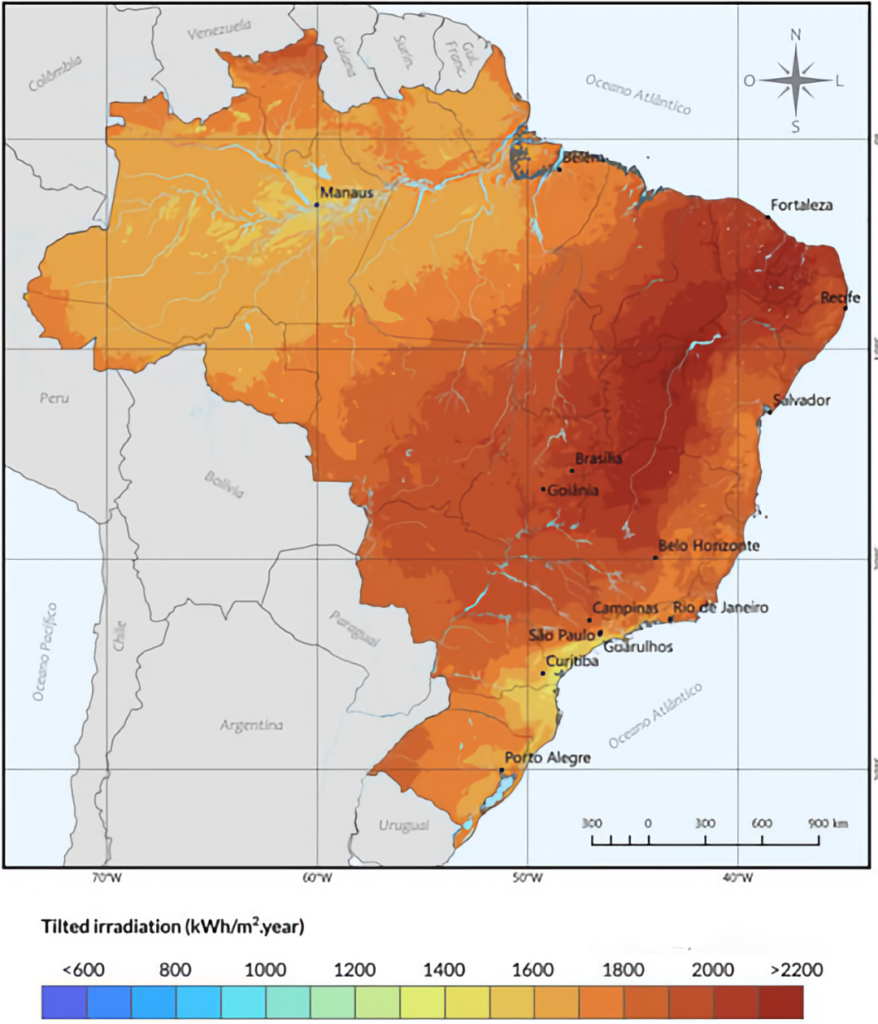

– Annual Irradiance: 2,018 kWh/m²/year.

Economic Aspects:

– Exchange Rate: We use the average exchange rate for the past 52 weeks (5.16), not the current exchange rate (5.35).

– Plant Cost (Capex): 11,800,000 BRL = 2,285,625 Euro

– Unit Plant Cost: 3,511,904 BRL/MWp = 680,245 Euro/MWp.

– First Year Gross Revenue: BRL 4,590,000 = BRL 677/MWh = €131.15/MWh.

– First Year Net Revenue: 3,130,000 BRL = 461 BRL/MWh = 89.43 Euro/MWh (32% reduction due to taxes and operating expenses)

Financial Performance:

– First Year Yield: 27%

– IRR (Internal Rate of Return) at 10 Years: 23%.

– Break Even: 3.77 Years

Additional Considerations:

– Irradiance ranges from 2,075 hours to 1,750 hours, dependent on technology (single-axis or fixed tracker) and location.

– Plant Cost varies depending on agreements with Chinese suppliers, import taxes, location, logistics, plant size, with a variation of +/- 7%.

– Revenue depends on regional tariff, distribution costs, and business model (B2B or B2C). In the B2C case and developing its own sales force is expected to increase revenue by 12-15%.

– We are aware of exchange rate fluctuations and are committed to providing safeguards through specific financial instruments to ensure prudent management of exchange rate risk.

– Fees and operating expenses depend on both contingent values and project-specific characteristics with a variation of +/- 4%

Economic and Environmental Considerations:

The photovoltaic system not only has an attractive financial performance, but also contributes significantly to the reduction of carbon emissions, supporting efforts to transition to more sustainable and clean energy sources.

The consideration of a PV plant in Brazil in the ESG balance sheet is possible and will depend on the actual ownership of the company and the management of energy production. At the point when the company directly owns the facility and manages its operations, the emissions and benefits derived may be included in Scope 1 or 2 areas, depending on the structure of the company and its activities.

Conclusions:

The project in Montes Claros offers a unique opportunity for investors interested in a growing market in renewable energy. With an initial yield of 27%, a 10-year IRR of 23%, and a Break Even of 3.77 years, this project promises to combine environmental sustainability and financial benefits.

Please note:

Comments on Joint Venture Costs and Opportunities for Photovoltaic Plant.

We would like to emphasize that the costs shown above represent real and tangible costs associated with the installation and operation of the PV system in Brazil. It is essential to note that these costs are direct and do not include any mark-up by the developer.

This transparency in costs is intended to stimulate thoughtful consideration and open the door to possible joint ventures. We believe that through strategic collaboration, benefits for both parties involved can be maximized, contributing to the sustainable development and expansion of renewable energy.

For those interested in a purchase of the PV system when it is fully connected, it is important to note that the target price is 1.2 million euros per MWp. To this amount must be added annual operating costs, which will be incurred through partnerships with qualified companies already identified by us.

This purchase perspective offers a clear and structured opportunity for those who wish to invest in an already operational PV system and benefit immediately from sustainable returns. We are ready to discuss this possibility further and provide more in-depth details for those interested in exploring this renewable energy investment opportunity.

Optimal Irradiation

Irradiance ranges from 2,075 hours to 1,750 kWh/m²/year, dependent on technology (single-axis or fixed tracker) and location.